1. What is Avalanche?

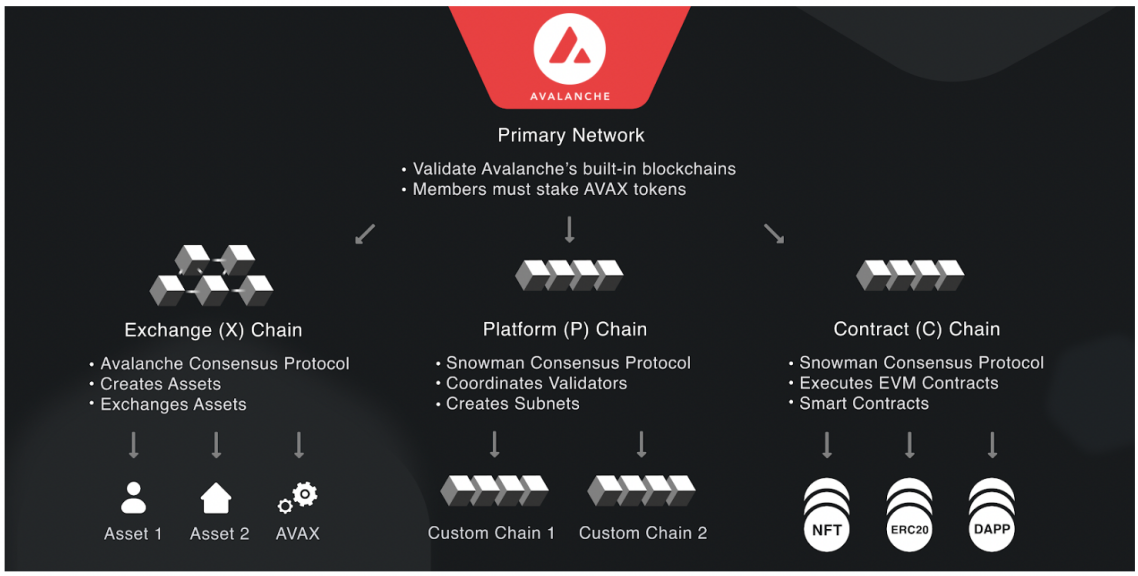

1) Avalanche, founded by Ava Labs in New York in September 2020, attempts to improve scalability without compromising speed or decentralization. Its Primary Network consists of three built-in blockchain networks:

2) Exchange (X) Chain: used for creating and trading AVAX tokens and other digital assets. Transaction fees are paid in AVAX via the Avalanche consensus protocol.

3) Contract (C) Chain: used for creating smart contracts. C Chain supports EVM-compatible DApps and uses the Snowman Consensus Protocol, which is a modified version of the Avalanche consensus protocol.

4) Platform (P) Chain: P Chain coordinates validators, tracks subnet activities, and provides support for creating Subnets. The chain also uses the Snowman Consensus Protocol.

All the three chains are verified and secured by Avalanche’s Primary Network.

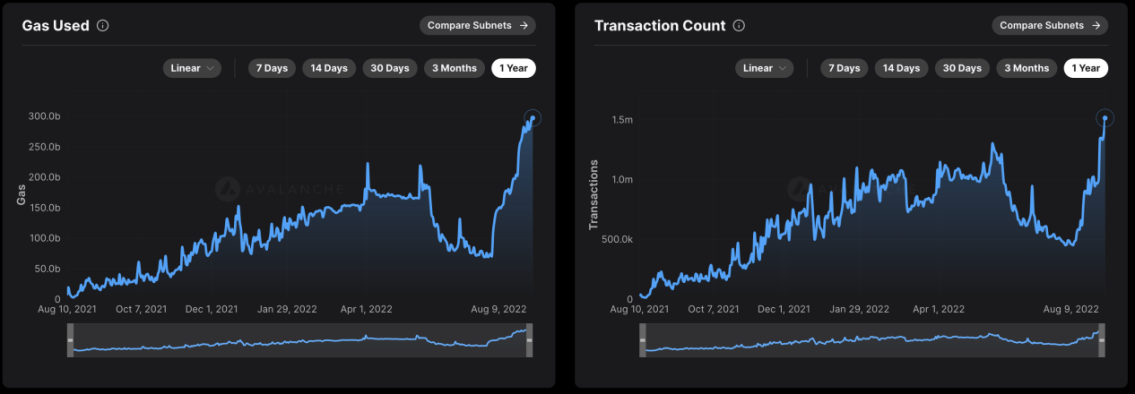

Avalanche equips each chain with different functions, which improves speed and scalability compared to concentrating all operations on one chain. In addition, developers may design tailor-made consensus mechanisms according to the needs of each chain. The Avalanche consensus is one of the greatest breakthroughs made by Avalanche: validators rely on repeated sub-sampled voting to achieve fast, affordable consensus. The network also uses Subnets as a new way to scale horizontally, which enables the creation of customizable, interoperable blockchains.

It is noteworthy that of the three chains, only X Chain uses the Avalanche consensus, which makes it an instance of the Avalanche Virtual Machine (AVM). At the moment, X Chain is often used for interactions between the Avalanche wallet and exchange wallets. However, this does not represent the great potential and extensive use cases of X Chain. One of Avalanche’s visions is to bring more conventional assets onto blockchains, which requires it to define assets. For example, some asset can only be traded by people in a certain country, or within a certain period, or in other specific scenarios. Avalanche’s whitepaper defined X Chain as “a decentralized platform for creating and trading digital assets”. Such functions could help Avalanche achieve its visions, yet are often ignored.

2. What is the Subnet?

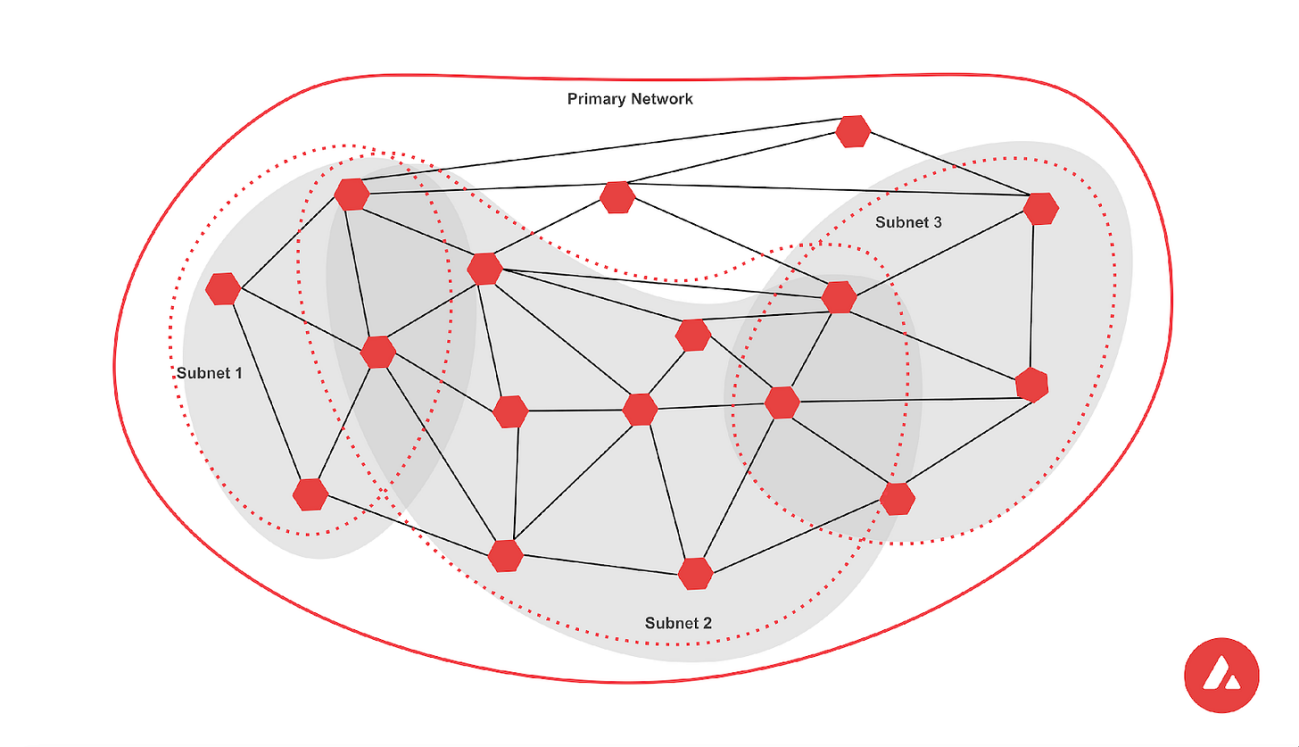

Similar to Ethereum, Avalanche also strives to improve the scalability and security performance of the network while keeping it decentralized, and Subnets are a key to achieving that vision. Avalanche’s Subnets use the Avalanche consensus, which is, simply put, a mechanism under which a node sends a transaction to a group of randomly selected validators and asks them whether the transaction is valid, and the answer given by most validators in the sample will be adopted as the group’s feedback. Next, the transaction will be sent to another randomly selected group with the same number of validators, and the above process will be repeated. The node will adopt the answer when the number of times it stayed consistent (consecutively) reaches a certain requirement.

Like the Primary Network, Subnets are responsible for validating and securing their own blockchain network. Essentially, a Subnet is a set of validators jointly responsible for the security of the corresponding network. This means that the Primary Network is also a special Subnet, and P Chain in the Primary Network serves all Subnets. Therefore, while the tailor-made Subnets create blockchains of their own, they still benefit from the security of the whole Avalanche network.

To become a Subnet validator, you must first stake at least 2,000 AVAX tokens on the Primary Network and become a mainnet validator. As such, Subnet validators are responsible for the Primary Network and its Subnet at the same time but do not have to process transactions on other Subnets. Within a Subnet, there can be multiple blockchain networks, all of which are maintained by the validators of that Subnet. That said, a validator node can act as the validator of different Subnets.

3. What are the features of Subnets?

Avalanche Subnets are highly autonomous to meet the demands of different projects.

a. Validator settings: Subnets can choose to have any number of validators to meet the demands of projects with different funding scales. On a Subnet, it requires at least five validators to ensure the healthy running of the network, and 10 validators are enough to keep the network secure and stable and to meet other needs that may arise in the future. Additionally, Subnets may also require some specific validator settings. For instance, it could ask validators to engage in KYC authentication in some countries to meet compliance requirements. This feature also applies to cooperation between companies. For example, a Subnet could grant one company control over validators to enable the internal circulation of information and avoid the leakage of commercial information;

b. Custom Gas Fee tokens: Subnets may adopt any token as the Gas Fee of the network, which makes the adopted token more valuable. In addition, they can also set the fee parameters to reduce expenses for users, which is a huge plus for GameFi and DeFi projects, especially those that have already established a large transaction volume. Such features enable the sound growth of projects over the long term;

c. Faster transactions: Subnets do not share network load with the mainnet, which means that they boast lower latency and higher TPS. Theoretically, there is no limit to the number of subnets one can create as long as there are sufficient validators;

d. Lower transaction fees: Compared to blockchains that run all the activities on one network, a multitude of Subnets and their validators come with less congestion.

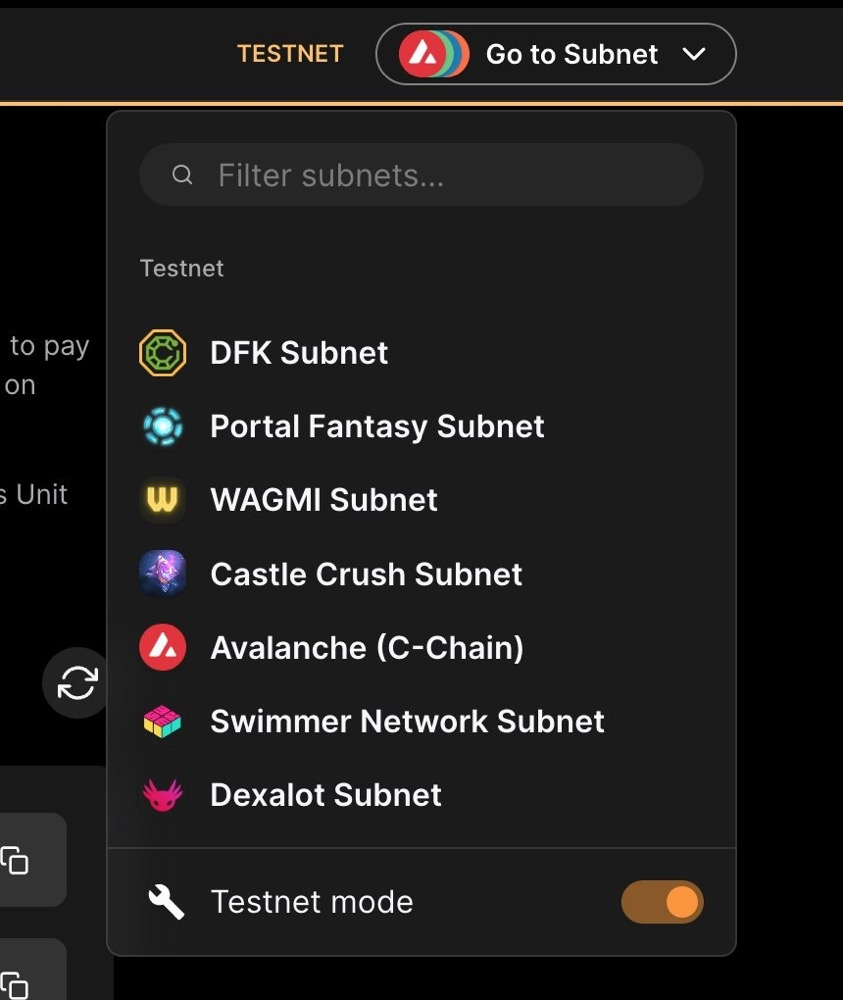

Generally speaking, the core potential of Subnets lies in the fact that users can customize the rules of the network, thereby building a chain that’s more suitable for their business. For instance, blockchains targeting GameFi projects often require nodes to have advanced hardware configurations, and such chains might also set other requirements for validators. Over the recent period, Crabada’s Swimmer Network and DeFi Kingdom’s DFK Chain are the two most popular game-focused Subnets. As they improve the speed of the network and provide incentives, both Subnets have adopted their primary token as the Gas Fee, which expands the application scope of their native tokens. At the moment, only a few projects have launched a Subnet, covering Ascenders, Shrapnel, and Cryptoseal (in addition to Crabada and DeFi Kingdom). Most of these projects focus on gaming and are now under development.

4.How do Subnets differ from L2?

Notably, interoperability between Subnets can be completed directly with each other without having to go through a beacon/relay chain. This means assets can move freely between Subnets, which enhances composability, one of the most valuable features of blockchain. Let’s imagine a future where Subnets are independent projects, like today’s Crabada and DeFi Kingdom. In that case, the direct communication between Subnets means better, faster interactions between projects, which allows the decentralized world to offer more satisfying user experiences. For instance, NFT Subnets could quickly connect assets to DeFi Subnets, and a gaming Subnet may migrate functions to another gaming Subnet in no time. Such functions are only possible with Subnets. At present, the communication between L2 projects is extremely complicated. They must go through the Ethereum mainnet to interact with each other, which is as secure as on a public chain. However, that incurs problems such as significant non-interoperability and fragmented liquidity. For example, when it comes to L2 solutions such as Arbitrium or ZKSync, assets have to be transferred through a third-party bridge (there is no mature, secure cross-chain bridge on the market for the time being) or the Ethereum mainnet. Furthermore, such assets cannot move freely between L2 projects, which makes it difficult for different DeFi protocols to coexist and deliver win-win results.

The list of advantages of Subnets goes on and on. For instance, it’s easy (and cheaper) to deploy a new blockchain using the Subnet approach, and the chain could reuse the same validators. Despite that, their flaws are also obvious: Subnets cannot benefit from the security performance of the main chain, and their cross-chain bridge is also more vulnerable to attack. Such poor security is also the inevitable cost of improving interoperability. In the meantime, as there are fewer nodes, Subnets are significantly more centralized.

Such pros and cons mean that the Subnet solution is extremely target-specific. In other words, it does not apply to all protocols. For instance, simple Subnets are not suitable for protocols with greater security demands such as DEXs and lending protocols, which are at the bottom layer of DeFi, and the consensus-enabled security of the Primary Network suits them better. In addition, as Subnets use their own Tokens for paying the Gas Fee and staking, the total asset worth of the network is also limited (lower than the total worth of the Token). Plus, such Tokens tend to be volatile, which makes the Gas Fee unstable.

All in all, Subnet settings are more suitable for asset-light protocols such as GameFi projects. Subnets constitute a great choice if you want to quickly deploy a new chain for your game as they are more composable and cheaper.

5.What are the use cases of Subnets?

DeFi: Apart from the lower transaction fees, the high customizability is also one of the advantages of building DeFi protocols with Subnets. Protocols can customize their subnets’ rules and functions based on their specific needs. For example, Ava Labs is collaborating with the Aave Companies, Golden Tree Asset Management, Wintermute, Jump Crypto, Valkyrie, Securitize and others to build a Subnet with native KYC functionality, targeting institutional DeFi. All DeFi apps hosted on this subnet could utilize this KYC functionality, removing the major regulatory roadblock adopted by institutions and enabling regulated institutions to explore the fast-growing DeFi space.

GameFi: Subnets could be a great choice for GameFi protocols as they will require their own dedicated blockspace instead of having to exist on the same chain as other protocols. Gaming protocols naturally require a lot of network capacity, and by existing on subnets, they don’t need to share traffic with other resource-intensive DApps. No wonder both new games and games on other blockchains, such as Shrapnel, Crabada, DeFi Kingdoms, Imperium Empires and Heroes Chained, are moving to Subnets.

Conclusion

Avalanche’s app-specific subnets provide an appealing, practical, and customizable way to scale blockchains. The features of Avalanche Subnets provide a unique value proposition for creators, developers, and users of L1 blockchains. Moreover, attracted by advantages such as fast interactions, quick transactions, and low fees, many protocols have adopted Avalanche’s Subnet as their on-chain solution.

Along with the boom of chains such as Cosmos, Polkadot, BNB (and its sidechains BAS), Near (a shard chain), and Oasis (a chain based on ParaTimes), the public chain field is becoming increasingly competitive. Relying on its unique Subnets, Avalanche could capture opportunities presented by the category. Amid the ever-changing landscape of the public chain sector, Avalanche Subnets boast a promising future.